Trends

V&S

Vision & Sensors

Why is Manufacturing Flexibility Important?

Headline

The need for this flexibility is likely to continue accelerating.

By Alberto Moel

Over the last year, we have been made acutely aware of the fragility and inflexibility of our manufacturing and supply chains. The pandemic has driven changes in demand patterns, not just what we are buying (more disinfectants and face masks, fewer suitcases), but where (at the grocery store instead of corporate purchasing). But this demand for manufacturing and supply chain flexibility is not new—it is only that we have been made painfully aware of this need from an external shock.

In reality, over the last couple of decades, stemming from changes in demand, competition, and market pressures, manufacturing has become a more complex and fraught affair requiring increased flexibility with a narrower margin of error. We can sum up this changing environment in three long-term trends affecting how stuff is designed and made: mass customization, increasing SKU proliferation, and shorter product cycles.

Mass customization and SKU proliferation

Let us say you are in the market for a new refrigerator. Consider the choices facing you: What color? Features? Form factor? Do you want the freezer on top, or on the bottom, or on the side? Would you like a water dispenser and an ice maker, or just the water dispenser? There is something for everyone, and if you do not like what you see, you can always pay a little more to custom build your dream fridge.

Imagine what it must be like for the manufacturer who must make so many different versions of the same basic appliance. Even the biggest appliance manufacturers probably only devote a couple of production lines per factory to refrigerators. To make all the variations demanded (or assumed to be demanded) by the consumer, a single production line must be able to build many kinds of fridges, each with different part counts, shapes, and even suppliers.

Detailed data on the SKU proliferation of household appliances has proven elusive, but we do have other data that makes the point, in a bit of a roundabout way, that mass customization and SKU proliferation in household appliances is real and here to stay.

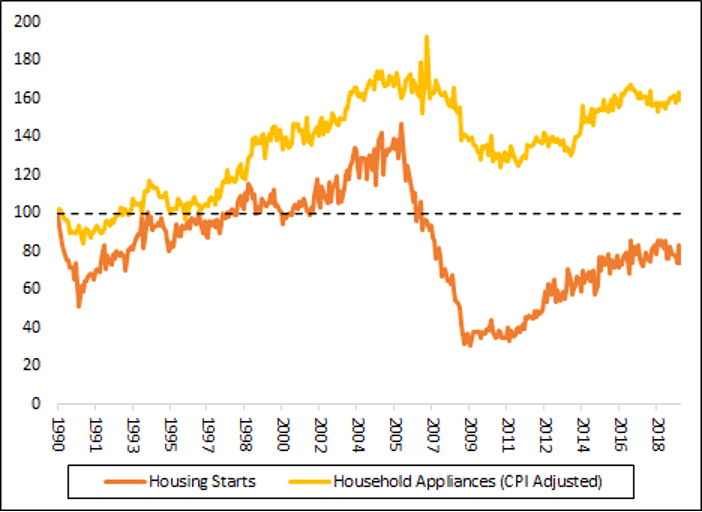

As an example, Figure 1 shows indexed U.S. housing starts against household appliance shipments in the U.S., where the value of appliance shipments is deflated by the consumer price index (CPI) of durable goods. We’re deflating the dollar value of household appliance shipments by the durable goods CPI in order to obtain a measure of household appliance shipments against housing starts.

Figure 1. Indexed housing starts and CPI-deflated household appliances, 1990-2018.

What we can see in this chart is that housing starts have fluctuated around a mean value for the last 30 years or so, cycling up and down in response to general economic conditions. And when a unit of housing is built, it needs to be outfitted with all our modern-day trappings: fridges, stoves, toilets, bathtubs, air conditioners, etc. Hence, one would expect household appliance shipments to track with housing starts. However, the data says that household appliance shipments have risen dramatically, almost doubling since the turn of the century.

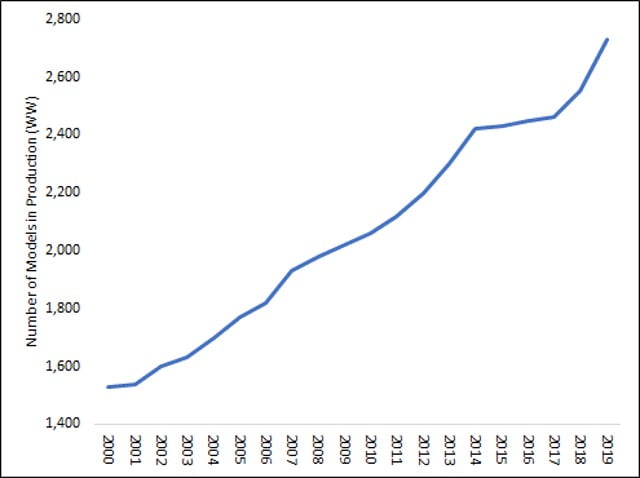

This Cambrian explosion of models and form factors is not limited to household appliances. Figure 2 shows data from IHS and Bernstein Research plotting the number of distinct car models (churned out by the same 20 or so global manufacturers) over the last few decades. Forget Henry “You can have it in any color, as long as it’s black” Ford. As economies grow and more and more people buy cars, vehicle customizations that meet specific geographic and market needs are more hotly requested. Though automobile manufacturers would much prefer to sell everyone the same car model in the same color, alas, people like to have more than one option. Automakers must have the flexibility to switch among models and option packages quickly (as in, from one car to the next).

Figure 2. Number of automobile models in production, 2000-2019.

These kinds of mass customizations and proliferations extend backward into the supply chains of durable goods and horizontally into other goods.

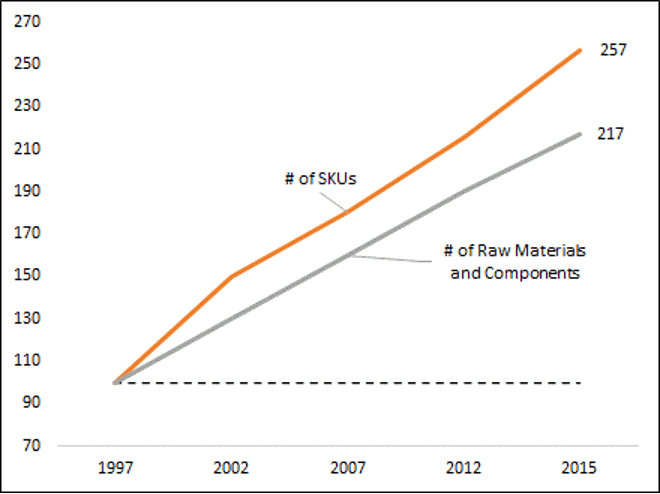

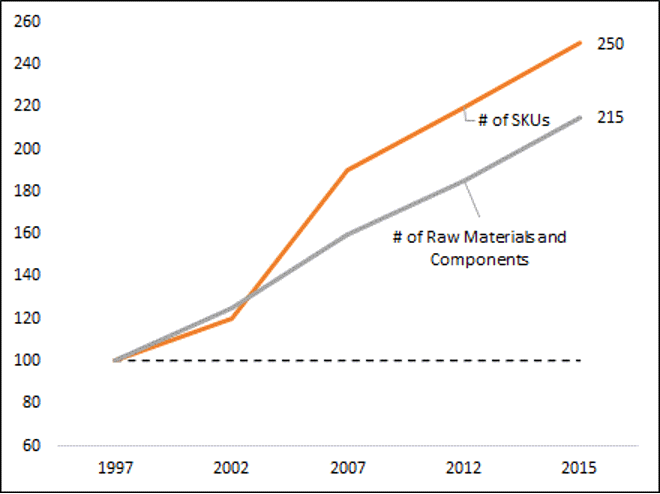

For example, Figure 3a shows a different cut from Roland Berger on the proliferation of automobile models, with added detail showing the increasing variety of raw materials and components. Manufacturers have made heroic efforts to minimize the diversity of raw materials and components through supply chain rationalizations and common platforms but can only do so much to slow the tide.

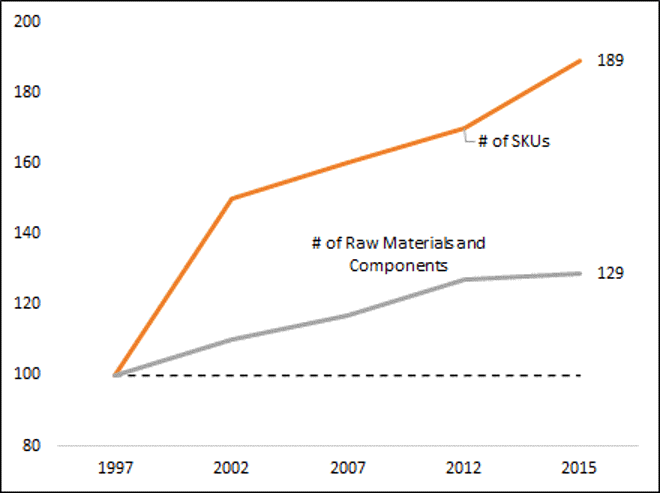

And, as one would expect, increased variation in materials and end products necessitates more variation and proliferation in the machinery and tools required for their fabrication. Figure 3b shows how these complications have reverberated backward to affect the array of machine tools required for automobile manufacturing.

Figure 3b. SKU and materials and components proliferation in automotive manufacturing machine tools.

Figure 3a. SKU and materials and components proliferation in automotive manufacturing.

Figure 4 shows that the good people at Roland Berger found a similar explosion of product variety in fast-moving consumer goods (FMCG) like toothpaste, toilet paper, paper towels, shampoo—you name it. This variability becomes particularly tricky once the FMCG have been packaged into individual containers (for example, shampoo bottles) and need to be boxed and palletized.

Figure 4. SKU and materials and components proliferation in FMCG.

Shorter product cycles

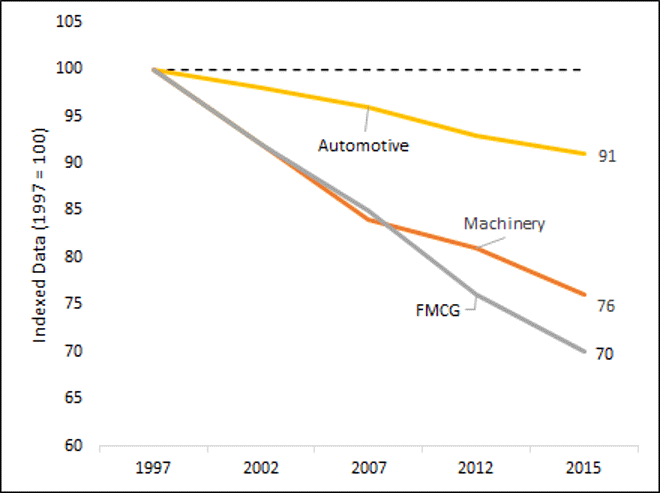

Figure 5 shows a different cut from the Roland Berger report on the shortening product life cycles in automotive, machinery, and FMCG.

In 1997, if the life cycle of an “average” car model was five years, by 2015, it was down to 4.5 years. In other words, car designers and manufacturers had six fewer months to design, develop, and ramp up manufacturing for that model. Fast moving consumer goods (FMCG), such as toothpaste or shampoo, have experienced much more dramatic shrinking of product life cycles. If the lifetime of your favorite Crest Peppermint-Flavored Extra Brightening with Triple Fluoride toothpaste was two years in 1997, it would be down to 1.4 years by 2015. This means more product introductions, more frequent product redesigns, and more frequent manufacturing changeovers require flexibility.

Figure 5. Product life cycle for automotive, machinery, and FMCG.

The data presented here (and extensive anecdotal evidence in fast fashion and consumer electronics) show that the trend toward shorter product life cycles is very real, and that consumers are more than comfortable with frequent purchases of new variations on existing products. Building flexibility into manufacturing processes is likely to be an existential requirement, and the need for this flexibility is likely to continue accelerating.

References:

Housing starts data is “New Privately Owned Housing Units Started, Thousands of Units, Monthly, Seasonally Adjusted Annual Rate” courtesy of FRED, from the St. Louis Fed. The household appliance data is Census Bureau data for Series 35B, “Dollar Value of Household Appliance Manufacturing, Seasonally Adjusted,” deflated by the Durable Goods CPI, “Consumer Price Index for All Urban Consumers: Durables in U.S. City Average, Index 1982-1984=100, Monthly, Seasonally Adjusted” from FRED.

About 1.5 million housing starts a year.

Mastering Product Complexity, Roland Berger Consultants, Germany. Their research encompassed surveys of over 100 manufacturers in five industry clusters (automotive, machinery, fast moving consumer goods, chemicals, and pharmaceuticals) about the number of end-product and supply chain SKUs over time and product lifetimes.

Opening Video Source: yangna / Creatas Video via Getty Images.

Remaining Images Source: via Getty Images.

Alberto Moel, VP of Strategy and Partnership, Veo Robotics

Scroll Down

Scroll Down